Smart Financial Planning Strategies : What Every Household Should Consider

The start of a new tax year is a natural moment to reassess your finances, set new goals and ensure your money is working as hard as possible. With the latest Budget confirming several freezes, reforms and long-term policy commitments, 2025 provides both challenges and opportunities for households looking to build financial resilience.

Here are the key areas worth prioritising this year:

1. Reviewing Your Savings and Cash Strategy

Rising interest rates over the last two years have transformed the savings landscape. Many high-street banks still offer low rates, but competitive options are available if you’re willing to shop around. Cash ISAs, easy-access accounts and fixed-rate savings products can all play a role depending on your goals.

With inflation now easing, real returns on savings are improving. Consider whether your current accounts are still competitive and whether you could benefit from splitting savings across multiple products, for example, keeping your emergency fund accessible while placing longer-term money into higher-yield options.

2. Taking Advantage of Tax-Efficient Allowances

Tax planning has become more important as thresholds remain frozen and more people experience “fiscal drag.” A few key allowances you should review each year include:

-

ISA contributions

-

Pension annual allowance

-

Personal savings allowance

-

Dividend and capital gains allowances

-

Marriage allowance eligibility

Making full use of these can significantly improve your long-term financial position—especially for families, self-employed individuals and higher-rate taxpayers.

3. Strengthening Your Retirement Strategy

Retirement planning is evolving, particularly with the proposed changes bringing unused pension funds into the inheritance tax (IHT) net from 2027. This means your pension strategy must be considered not just in terms of income, but overall estate planning.

Key considerations include:

-

Are you contributing enough to meet your retirement goals?

-

Are your pension investments still aligned with your risk level?

-

Have you reviewed your beneficiary nominations recently?

-

Would consolidating older pensions simplify your financial picture?

Speaking with a professional can help ensure you’re making the most efficient decisions.

4. Reviewing Protection and Household Budgeting

From mortgage protection to income protection, many households hold outdated or insufficient cover. With higher living costs, unexpected events can have a larger impact than before. Likewise, reviewing your monthly budget can help identify inefficiencies and redirect money toward more important goals.

Building a Strong Financial Future

2026 offers a chance to reset, refine and strengthen your financial foundations. Whether you’re looking to grow your savings, plan for retirement or simply feel more confident about your finances, the Clear Finance team is here to support you every step of the way.

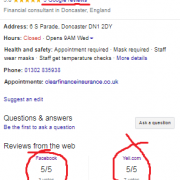

For more information about our Financial Services and products in Doncaster call 01302 835938

Please ’Like us’ on Facebook – https://www.facebook.com/clearfinance.net/